Find Your Dream Car in JBA Indonesia

How to check East Java vehicle tax can be done online, allowing vehicle owners to avoid spending time visiting a Samsat office. Checking vehicle tax is an important step to always know the amount that must be paid and to ensure the vehicle remains legally compliant when used on the road.

For East Java residents or those who want to buy a used car and need to verify its tax status first, please refer to the following information. By understanding how to check vehicle tax online, you can ensure your tax obligations are consistently fulfilled and avoid late payment penalties.

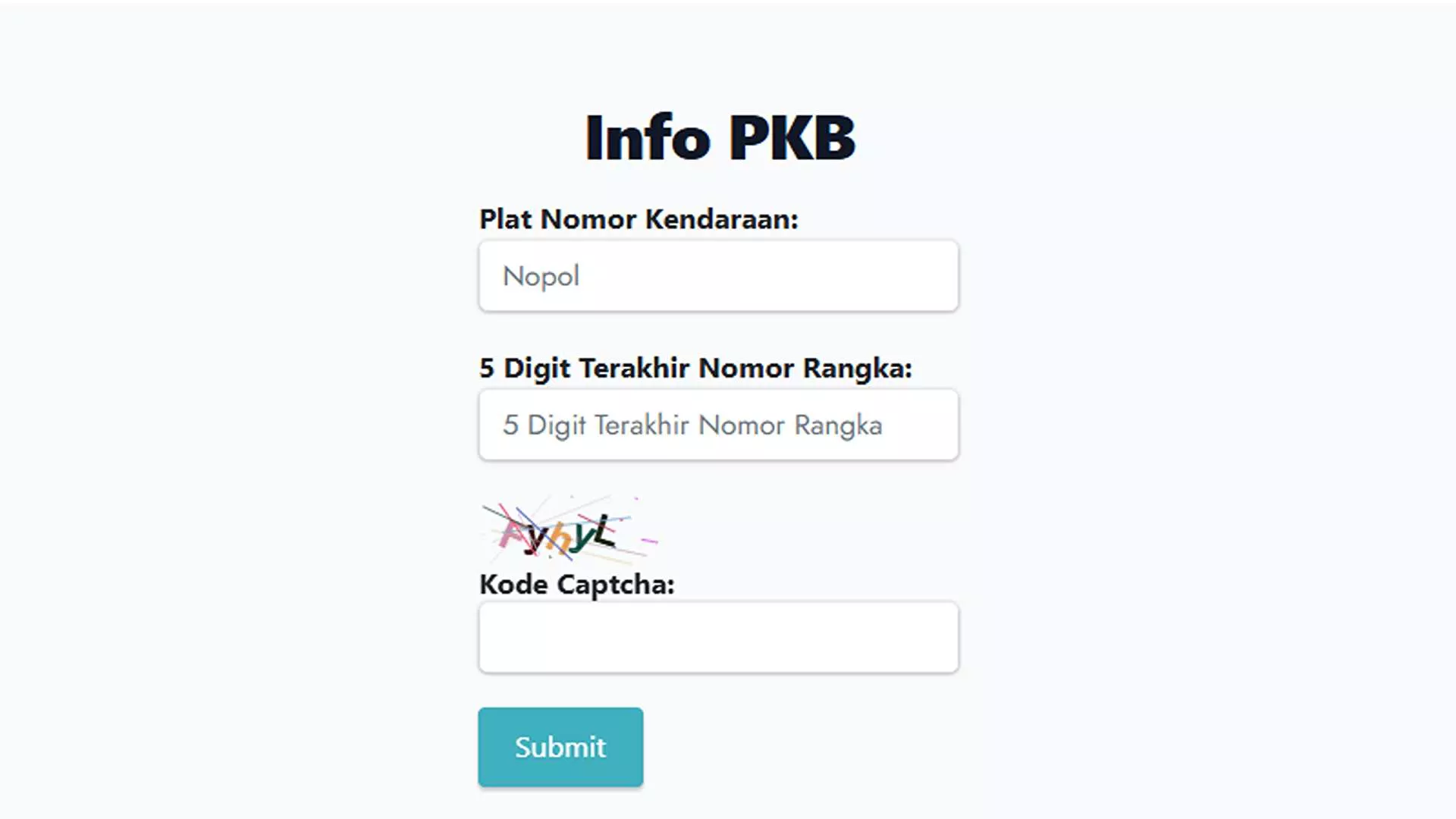

To obtain Motor Vehicle Tax (PKB) information for the East Java region, you can access the East Java Bapenda Info Service website. Here are the steps:

The Regional Revenue Agency of East Java Province (Bapenda Jatim) provides a motor vehicle tax checking service through its official website, bapenda.jatimprov.go.id. How to check East Java vehicle tax can be done with the following steps:

Sumber: bapenda.jatimprov.go.id

In addition to the official Bapenda website, you can also check East Java vehicle tax using the SIGNAL app. This official digital service from Korlantas Polri can be used by people throughout Indonesia, including vehicle owners in East Java. Here are the steps:

One of the most practical ways to check vehicle license plates in East Java is by using the SMS service. This method is very simple because it does not require additional apps and can be done from any mobile phone.

Here are the steps:

When you check East Java vehicle tax, especially if your purpose is to buy a used motorcycle or car, there are four important aspects that you must pay attention to so you can obtain a vehicle that is administratively safe and avoid unexpected costs.

Make sure the vehicle’s tax status is still active. If the status shows overdue tax, you must prepare additional costs to pay PKB, SWDKLLJ, and other potential arrears.

The expiry date is essential, especially for used vehicle buyers. The online system usually displays two key dates: the annual PKB due date and the five-year STNK validity. If both dates are near or already overdue, you must consider higher renewal costs.

Information on the PKB amount, SWDKLLJ, and potential late penalties will appear when you check the vehicle tax. This is very important for used vehicle buyers to estimate the total cost that may need to be paid after purchase. If there are penalties or arrears, you should consider them first before making a transaction.

When checking vehicle tax, the system will display details such as the brand, model, type, color, year of manufacture, chassis number, and engine number. Ensure all data match the physical documents (STNK and BPKB) and the actual condition of the vehicle.

Through the various digital services available, checking East Java vehicle tax online provides many benefits for vehicle owners. You can monitor the tax amount, ensure legal compliance, and avoid penalties due to late payments.

For those considering buying a used vehicle, JBA Indonesia offers motorcycle auction halls and car auctions that are safe, transparent, and flexible. JBA has many branches in various cities across Indonesia, including the East Java region, allowing you to participate in auctions online or visit the nearest location in person.

If you have any questions, please contact WhatsApp +62 817-0993-078. Be sure to follow all official JBA Indonesia social media accounts to stay updated with the latest auction schedules and other updates.

Menjelang Lebaran,...

Solusi Tunda Bayar hingga...

The Jambi online vehicle...