Find Your Dream Car in JBA Indonesia

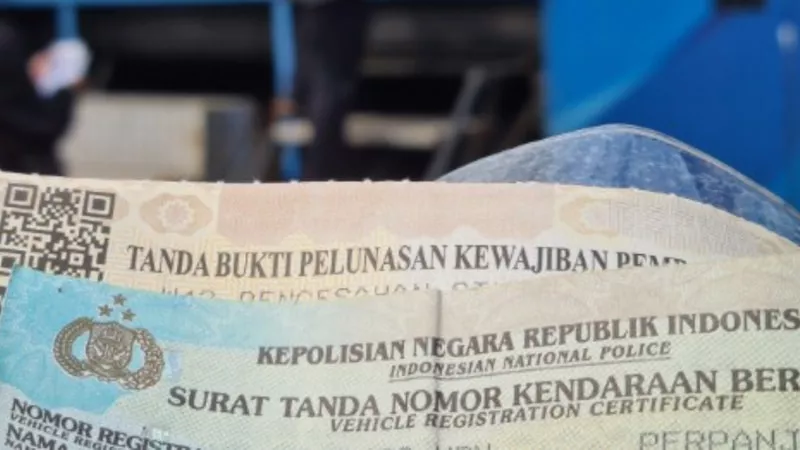

Vehicle tax is an obligation that must be fulfilled by every motor vehicle owner in Indonesia. However, the tax payment process can sometimes be complicated, especially if you do not have the owner’s ID card. But did you know that there is a way to pay motorcycle tax without having the owner’s ID card? In this article, we will discuss in detail how to pay motorcycle tax without the owner’s ID card, including the requirements that must be met, the payment methods, and the penalties that will be imposed if you are late in paying the tax. With this information, you can renew your vehicle registration smoothly and without obstacles.

Baca Juga: Cara Melihat Pajak Motor di STNK dengan Benar

This question often arises among vehicle owners who face issues related to having the owner’s ID card. In fact, whether or not you can renew your motorcycle registration without the owner’s ID card depends on various factors and applicable procedures.

According to the National Samsat Office, renewing a vehicle registration without the previous owner’s ID card can be done in several ways, one of which is by transferring ownership. You can visit the nearest Samsat office to carry out the ownership transfer process. Make sure to prepare the necessary documents for the process.

However, if you are in certain situations, such as losing your ID card, the authorities provide a facility for renewing vehicle registration without the ID card. You can obtain a Loss Report Letter issued by the local urban village or district office where the vehicle owner resides. This letter can be used as a substitute for the ID card for verification in the registration renewal application.

To make renewing your vehicle registration easier, here are several ways to pay motorcycle tax without the owner’s ID card that you can apply. These steps can help you fulfill your obligation to pay vehicle tax more easily and efficiently.

Baca Juga: Cara Perpanjangan STNK Tanpa BPKB, Sudah Tahu?

Sumber: freepik.com

Before learning how to pay motorcycle tax without the owner’s ID card, it’s best to first understand the necessary requirements. Here are some conditions you need to pay attention to if you want to renew a motorcycle registration without the registered owner’s data:

By meeting these requirements, you can proceed with the motorcycle tax payment process without needing the matching owner’s ID card. Although there may be obstacles, there are steps you can take to fulfill your tax obligations and renew your vehicle registration on time.

Baca Juga: Cara Mengurus STNK Hilang yang Harus Dipahami

Sumber: freepik.com

Facing a situation where you need to renew your motorcycle registration (STNK) without having the owner’s ID card can be challenging. However, there are several ways you can still fulfill this obligation. Here are some methods to pay the tax and renew the motorcycle registration without the owner’s ID card:

One method you can use is the SIGNAL application. This renewal process allows you to fulfill your obligations without needing the matching owner’s ID card. You can easily make the payment online by following the steps provided in the application.

Here are the steps:

Note: Online STNK renewal through SIGNAL is only for annual STNK renewals or STNK validation. The only original document sent is the SKKP PKB sheet.

Another method you can try is paying the motorcycle tax via SMS. Some motorcycle tax payment services offer the option to make payments through short messages (SMS). You simply follow the instructions provided in the SMS to complete the motorcycle tax payment without having to visit the office or possess the owner’s ID card. In this case, you need to send an SMS to the Regional Revenue Office Gateway number available in the Samsat application. Here are the steps:

One effective way to pay motorcycle tax without the owner’s ID card is by transferring the ownership name on the Vehicle Registration Certificate (STNK). Even if you do not have the previous owner’s ID card, you can process a name transfer to the new owner.

This name transfer process is carried out at the SAMSAT office and involves a physical inspection of the vehicle. This step is conducted by SAMSAT officers to record the vehicle’s chassis and engine numbers.

The results of the physical inspection will be combined with the documents you have prepared and submitted to the officer at the physical inspection registration counter. The next steps are as follows:

The process for submitting a name transfer application is as follows:

The next step is updating the data in the BPKB. This process takes several days and must be done at the local Regional Police (Polda) office.

If you wish to collect the STNK, you must visit the name transfer counter and submit the receipt previously issued, along with the original ID card, original BPKB, purchase receipt, and the vehicle’s physical inspection result.

The name transfer process is not yet complete because the BPKB still needs to be updated. To process the BPKB, you must visit the local Polda office. Make sure to bring a photocopy of your ID card, a photocopy of the new STNK, a photocopy of the physical inspection result, a photocopy of the motorcycle purchase receipt, the original BPKB, and a photocopy of it.

Once all required documents are prepared, the next steps are:

It is important to keep the receipt and the original proof of payment, as these are required to collect your new BPKB on the specified date.

When collecting your new BPKB, you can return to the Polda office and take a queue number. Submit the receipt along with the proof of payment and a photocopy of your ID card to the counter officer. The officer will hand you the new BPKB, and the name transfer process will be complete. Once the registration data update is finished, you can pay your motorcycle tax using the new owner’s ID card, in accordance with the established requirements.

Baca Juga: Cara Hitung Pajak Motor Tahunan dan Lima Tahunan dengan Tepat!

Paying motorcycle tax without the owner’s ID card can be done by following one of the methods described above. This way, you can still pay your motorcycle tax and renew your STNK without having the registered owner’s ID card. Make sure you choose the payment method that best suits your needs and convenience.

From the guide above, it is expected that you will find it easier to fulfill your obligation to pay vehicle taxes comfortably. This is especially important if you are planning to own a new motorcycle. Be sure to take care of all vehicle taxes so you can use your motorcycle with peace of mind, without worrying about penalties or fines.

If you have not yet found a motorcycle that suits you, you can participate in motorcycle auctions from JBA Indonesia. On this platform, you will find a wide range of motorcycles at competitive prices. JBA Indonesia also offers car auctions with various brands and models, allowing you to find a vehicle that suits your needs, whether for personal use or business, at competitive prices.

In addition, JBA Indonesia provides a Vehicle Consignment Service for cars or motorcycles if you plan to sell your old vehicle. With this service, you can sell your vehicle without the hassle of handling the sales process yourself, as the professional team from JBA Indonesia will assist you from the marketing stage to the auction process.

So, don’t hesitate to make JBA Indonesia Automotive Auction House your best solution for getting your dream vehicle easily and conveniently!

Motor listrik semakin...

Yamaha, sebagai merek motor...

Sebagai merek premium yang...