Find Your Dream Car in JBA Indonesia

Understanding the requirements for paying motorcycle tax is essential to ensure the process runs smoothly without having to return due to missing documents. Many vehicle owners are still unsure about which documents to bring, especially when paying annual or five-year motorcycle taxes.

For that reason, this article can help you understand the process more easily. Here, you will find a complete explanation of the requirements and how to pay motorcycle tax, so you can prepare everything properly without confusion.

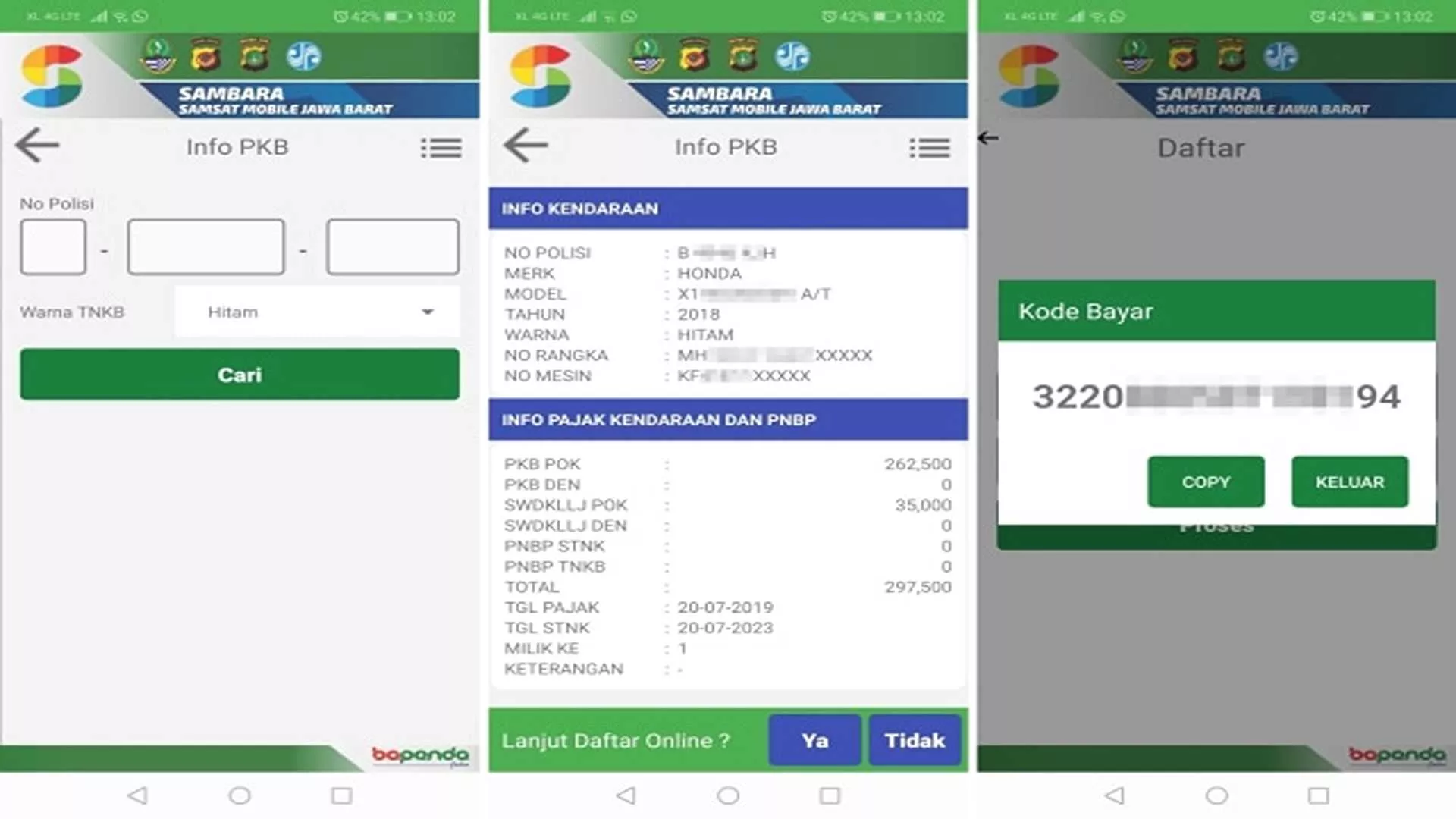

The annual vehicle tax is a mandatory tax that vehicle owners must pay each year to the local government. This payment is one of the key requirements for STNK validation and serves as proof that the vehicle has fulfilled its legal obligations to be used on public roads. To pay the annual tax, prepare the following documents:

The five-year vehicle tax is paid along with the replacement of the STNK and the Vehicle Number Plate (TNKB). This is because the validity period of both STNK and TNKB is five years, which is why this process is known as the five-year tax.

Below are the requirements for paying the five-year motorcycle tax:

The five-year vehicle tax cannot be paid online. Vehicle owners must visit the Samsat office in person because a physical inspection is required. The process is straightforward, as follows:

To ensure a smooth motorcycle tax payment process, make sure all requirements are met and all necessary documents are prepared. Here are some tips that can help:

Sumber: www.negarabatin-by-su.com

STNK, BPKB, and your ID are essential documents you must bring. Make sure they are stored neatly so they can be easily accessed when needed.

Sumber: kumparan.com

Always check when your motorcycle tax expires. Paying on time not only prevents penalties but also ensures that your STNK renewal process goes smoothly.

Sumber: kumparan.com

For the five-year tax, a physical inspection is one of the required steps. Regular servicing helps keep your motorcycle in good condition, making the inspection process faster and trouble-free.

Understanding the requirements for paying motorcycle tax is essential to ensure a smooth process and keep your vehicle legally allowed on the road. By preparing the documents early, you can avoid issues and ensure your tax obligations are fulfilled on time.

If you are currently looking for a used motorcycle, joining a motorcycle auction at JBA Indonesia can be a suitable option. JBA provides a safe and transparent auction process, allowing you to find the vehicle you want with confidence.

If you have any questions regarding auction activities at JBA, feel free to contact us via WhatsApp at +62 817-0993-078. Don’t forget to follow all JBA social media accounts to stay updated on the latest auction information.

Checking toll rates before...

For those of you planning...

The process of installing...